US Dollar Index Chart Poised for a Resounding Surge

Updated April 15, 2024

Every target we projected for the dollar in 2022 was successfully reached. These targets were often set 18-24 months in advance, offering ample time for our subscribers and readers to position themselves accordingly. Now, let’s delve into the dollar’s current status as of April 15, 2024.

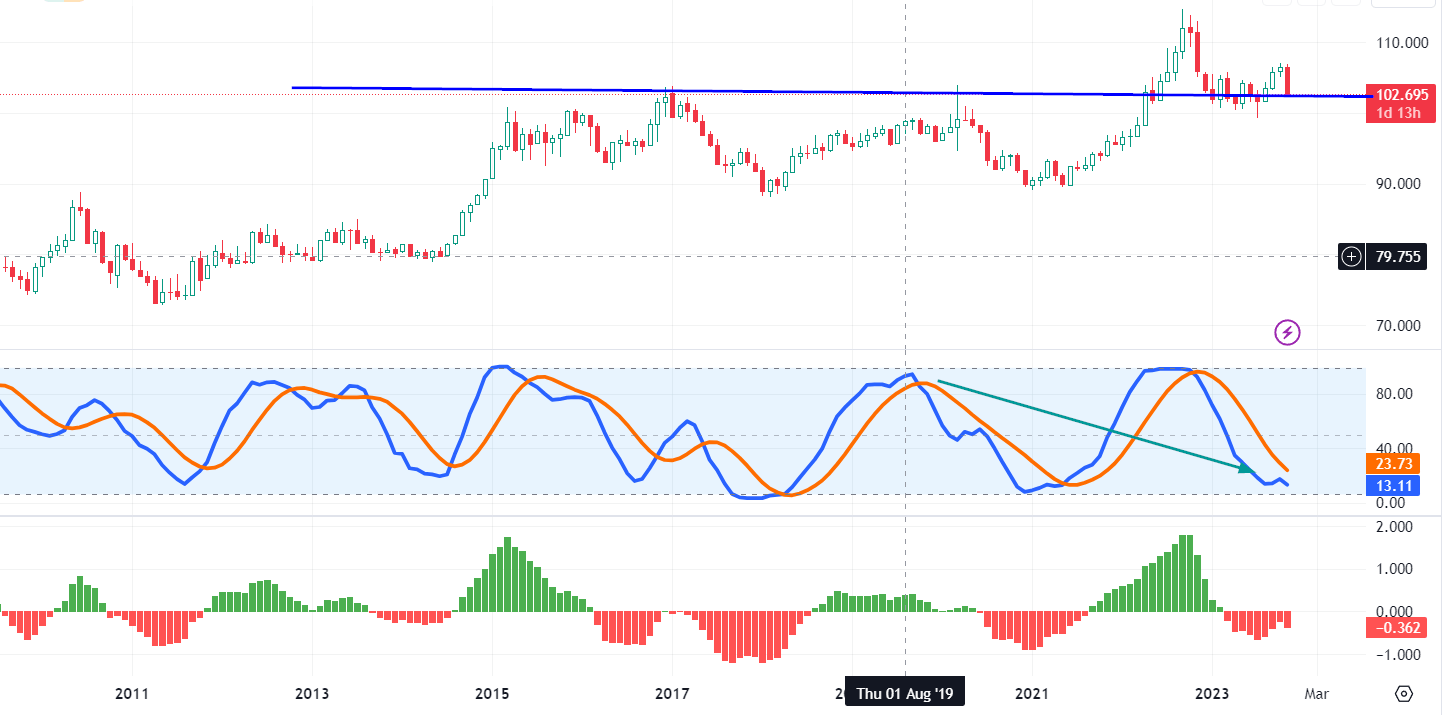

The dollar didn’t quite follow the ideal script, emphasising the rarity of these “ideal” scenarios coming to fruition. Instead, it embarked on a fairly decent rally but encountered resistance in the 104.85 to 105.00 range. The likelihood is that it will test this resistance zone again and then pull back. Currently, the weekly picture isn’t crystal clear. There’s a chance it could dip back to the 100 range, triggering a positive divergence signal in the process. However, a more likely scenario entails the dollar finding support in the 102.80 to 103.20 range. Market update February 19, 2024

The dollar followed the “more likely scenario” path, trading as low as 102.30 on March 8 before closing the day at 102.69, comfortably within the suggested target range. Now, the key test lies in whether it can trade at or above 105.00; if it can, it would be the first signal for higher prices.

However, until it manages to secure a weekly close above 107.10 or a monthly close above 105.90, the dollar is likely to continue testing the 103 range. Behind the scenes, there’s a significant battle underway that many are overlooking. Were it not for the quiet but important factor of resource remobilisation, the dollar might have easily breached 105.90 by now?

Looking ahead, the longer-term outlook for the dollar is not too bright. Failure to achieve the aforementioned milestones could exacerbate the situation, and if it does manage to hit those targets but fails to test at least 112.50, the outlook could worsen further.

To fund its voracious appetite, the U.S. depends on a continuous supply of new buyers, which is dwindling. This sets the stage for the next unsavoury move: debt monetisation. History has repeatedly shown that such manoeuvres tend to lead to unfavourable outcomes. Market update February 19, 2024

The growing alliance between Russia and China poses a significant challenge to the United States. It’s puzzling why the U.S. would inadvertently push these two nations into each other’s arms. The U.S. would struggle to prevail in a military or economic conflict against this formidable duo in any conceivable scenario. Additionally, Africa, a vital player in the commodities market, is increasingly aligning itself with Russia and China, further complicating matters for the U.S.

There’s a looming risk of the U.S. facing a crisis akin to the collapse of the Soviet Union. However, efforts to rein in the deficit and avoid initiating new conflicts could potentially slow down this negative trajectory. A red flag signalling the worsening situation is if the Federal Reserve overtly monetises U.S. debt. Such action often signals the beginning of the end for a nation’s economic stability.

US Dollar Index Monthly Chart

The dollar has seen a remarkable rally, yet it’s still trading in the highly oversold range on the monthly charts. This fact alone indicates that the buzz surrounding the BRIC currencies is flatulence. On a deeper level, it highlights the intricate nature of the Russian and Chinese strategy to create a resource-driven geopolitical dynamic. “As long as the dollar remains above 101.55 monthly, the outlook stays bullish. Sharp pullbacks should be seen as buying opportunities.”

Global Shifts: How the West’s Actions Play into Russia’s Hands

It’s worth noting that if the U.S. hadn’t pushed Russia to its limits, it might not have pursued this course. While the Chinese possess the patience to wait for decades for their strategies to unfold, the Russians excel at orchestrating intricate geopolitical manoeuvres, much like masters of a chessboard. Yet they have a distinctive pattern or flaw, whichever way you perceive it – they don’t typically act until they are pushed to their limits or their red line is crossed. It’s challenging to discern either one definitively, but one sign is their increased vocalisation as you draw near that line.

The West’s actions have triggered yet another peculiar pattern in the context of Russia. When the Russian bear is provoked or activated, it persists until it has neutralised its perceived enemy. It’s vital to emphasise that this doesn’t necessarily indicate the onset of a full-blown war. If a conflict emerges, the West will more likely initiate it, with the U.S. taking a lead role. Russia’s strategy seems to revolve around resource-focused strife but will engage in a hot war if pushed.

However, one critical aspect the West should be concerned about is that the Russian Bear, though currently irritated, has not yet reached a state of anger. If it were to reach that point, the situation could deteriorate significantly, particularly in Europe.

The actions of the West have inadvertently played right into Russia’s hands and, by extension, into China’s as well.

When we survey the geopolitical chessboard, it becomes evident that even traditional adversaries like Saudi Arabia and Iran have forged peace and aligned themselves with Russia. Meanwhile, China’s formidable powerhouse has established an unbreakable bond with Russia in Asia. Despite the noise from experts, this bond will likely endure and strengthen for decades. Significant portions of Africa, including the influential South Africa, have also aligned with Russia, and several nations in South America are following suit.

It’s essential to acknowledge that today’s China is vastly different from the China of Mao Zedong, and Russia is no longer the Soviet Union of Stalin or Yeltsin. Both of these nations are formidable powerhouses in their own right.

This video highlights just how fast Russia is advancing. Russia also has a bullet train and is working on other routes. In the US, we are still riding the donkey express. China is still the undisputed heavyweight champion regarding bullet train networks.

In summary, while the dollar will experience a rally, the ongoing resource war can mitigate its effects significantly. Related to this topic, the Federal Reserve can expect to announce a new norm for inflation. The days of the 2% target may be behind us.

Let’s delve into the current subject while considering its historical context, as we initially emphasized.

US Dollar Chart: Bullish Signals for Prolonged Uptrend

The outlook for the US dollar Index (and, by default, the US dollar)remains quite bright; its present trajectory indicates that it is set to batter all the other major currencies. If the EU decides to engage the Trump administration in a trade war, the Euro will almost certainly trade on par with the dollar.

On a separate note, the Fed has tremendous leeway once we enter the next stage of the currency wars. By hiking rates early on the cycle, the Fed can quickly lower them if the need arises, and any nation that decides to match them will experience a rapid decline in the value of their currency. A rapid fall in the value of a nation’s currency will unleash the inflation beast, and that is something countries like China can’t afford right now. We are in the midst of a massive currency war.

For now, the US has many weapons to deploy against any nation that decides to engage it. We suspect that Europe will choose to work with the US as this will give both Europe and the US a chance to push China to the negotiating table. It will be a painful blow for the leaders, but the Chinese people will benefit from this move as it will trigger a movement in China that will resemble what took place in Taiwan years ago when it broke away from mainland China. However, that’s a story for another day.

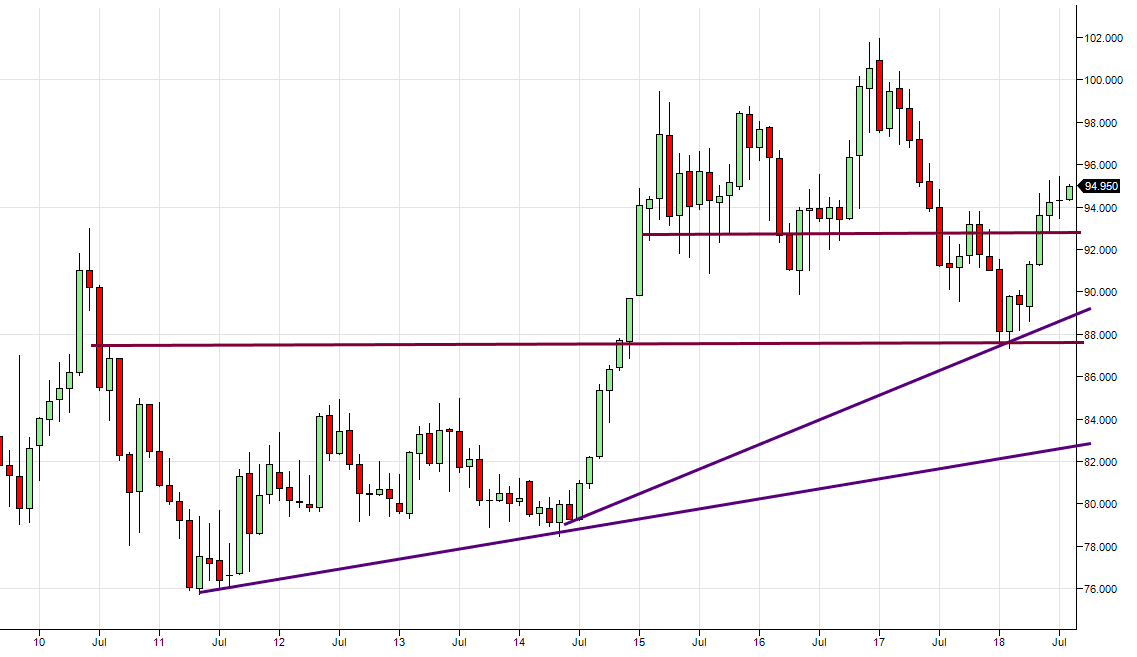

US Dollar Index Chart In Bullish Mode

The US dollar index chart (above) is very bullish. Note that it’s trending well above the main uptrend line, and it would have to break through two levels of solid support to have any chance of ending this bull market. The first strong layer of support comes into play in the 88.00 range, and then an even stronger layer of support comes into play in the 83.00 range. The dollar would have to close below both these levels monthly to indicate that lower prices were on the horizon.

US Dollar Outlook After Trade War With China

The chances of the dollar trading below 92.00 on a monthly basis are low, given the current momentum and trade war atmosphere. Additionally, the US economy is strong, with a GDP of 4.1% for the quarter and high consumer sentiment. In comparison, Europe’s growth rate is slow, and China is gradually becoming isolated in the trade war. The Chinese markets have already indicated that China cannot win the trade war, and their only choice is to surrender and come to the negotiating table. The longer they fight, the worse the terms will be.

The monthly chart of the dollar index shows that it has enough room to move before hitting the overbought ranges. However, on the weekly charts, it is currently trading in the overbought ranges, indicating it is time for the dollar to consolidate. The dollar could trade as low as 92.00, with a possible overshoot to the 91.00 range. Therefore, it is recommended that strong pullbacks be used to establish new long positions in the US dollar index.

What’s the Outlook for the Euro

On the one hand, the Euro is trading at deficient levels on the weekly charts, indicating that it is eager to trend higher. Those willing to take risks can consider opening long positions during strong pullbacks to close them within the next 3-6 weeks. It’s important to note that this is not a long-term investment strategy. Once the consolidation in the US dollar index is over, it is expected to rise significantly, and the Euro is predicted to continue its downward trajectory.

The US dollar Index Is Now Overbought.

The US dollar index trades in highly overbought ranges on both the weekly and monthly charts. Therefore, the path of least resistance is consolidation or sideways action with a slow drift downwards. But why a slow drift and not a massive pullback? This is because the US still offers the highest interest rates in the developed world and is, therefore, one of the most attractive places for investors seeking safety to park their money. Secondly, as the US lowers rates, the rest of the developed world will be forced to lower rates. In most cases, these rates will turn negative since none of these countries raised rates as much as the US did.

Hence, the bottom line for 2019 is that the dollar will consolidate. Dollar bulls should view any pullbacks through a bullish lens. The stronger the deviation, the better the opportunity.

April 2020 Update on US dollar

Due to the coronavirus pandemic, the Dollar will continue to reign supreme for the foreseeable future. Hence, traders should focus on the weekly charts and open positions whenever the technical indicators are trading to extremely oversold ranges.

A bigger bang would come from opening up long positions in US equities, which you gain from both sides: capital appreciation as the stock market trends higher and currency appreciation if you are residing in a country outside the U.S.

USD Outlook Dec 2023 Update

The dollar managed to end the week above 103.70; it closed at 104.19. The dollar is now ready to rumble. It’s pretty interesting to note that during the rate-hiking process, the dollar pulled back. What will puzzle many is that it will continue to trend higher during the initial stages of the rate-lowering process. Don’t be surprised if the dollar initially pulls back before surging higher. The path is now in motion for the dollar to test the 108 to 109 range. Before the next top is in place, the USD will trade a lot higher. Market update September 7, 2023

The dollar “rumbled,” surging as high as 107.50 before pulling back. It’s likely to consolidate on the weekly charts. If the consolidation is mild, then the dollar will mount an even stronger comeback. Either way, the dollar is destined to rally higher before putting in a long-term top. However, if the consolidation is minor, then the follow-through rally will be even stronger. A monthly close at or above 107.10 will set the path for a test of the 112.50 to 113.60 range. Market Update October 12, 2023

Other Articles of Interest

What are the most insightful books about human psychology that everyone should read?

Stock Market Fears: Don’t Let Panic Rule—Opportunity Awaits!

Free Market Manifesto: Embrace the Chaos, Seize the Opportunity!

Is the market retracement meaning key to predicting price reversals?

Will the stock market crash soon?

Are any countries on the gold standard?

Are stock market losses tax deductible?

Best Investing Strategy: Where Psychology Meets Rationality

Is market manipulation illegal?

What are the best books on human psychology?

How would a successful investor define emotional discipline?

Why should I invest in stocks?

Skip Human Psychology Books: Learn Everything from the Market

What is efficient market hypothesis?